An angel investor is an individual who provides capital for a business start-up, in exchange for convertible debt or ownership equity. The capital provided by Angel Investors may be a one-time investment, or it may fund money during the initial stage to support and carry the company through its early stages.

We have partnered with the following Angel Investors:

Chennai Angels

The Chennai Angels (TCA) is an angel investment group based in Chennai, India. They have funded companies such as Popxo, Metroplots, Traveling Spoon, HitWicket, Brigge, Cloud Cherry, Syona Cosmetics, Velvet Case, Fourth Partner amongst others.

Native Lead

Nativeleads are a one-of-a-kind platform for empowered and established natives of various small towns to interact with aspiring entrepreneurs from the region. Through Nativeleads, the leaders can invest their well-cultivated Expertise, Knowledge, Contacts, Wisdom, Time & Money in the entrepreneurs to reap wholesome and soulful returns.

Let’s Venture

Let’s Venture began with the simple premise of making fundraising easier for startups in the year 2013. Let’s Venture was introduced as India's first online investment platform. Three years later, they have evolved much bigger to make angel investing easier.

Mount Judi Ventures

MJV has been started by successful entrepreneurs with a vision of creating wealth through mutually fair and equitable venture capital investments. MJV brings together investors, individual and institutional, along with ambitious and promising entrepreneurs/promoters of ethical businesses to participate in the high growth story of new India.

IVCA

IVCA is a non-profit organization powered by its members. The member firms comprise influential firms from around the world, including Private Equity & Venture Capital Funds, Corporate Advisers, Lawyers, and Institutional Advisors.

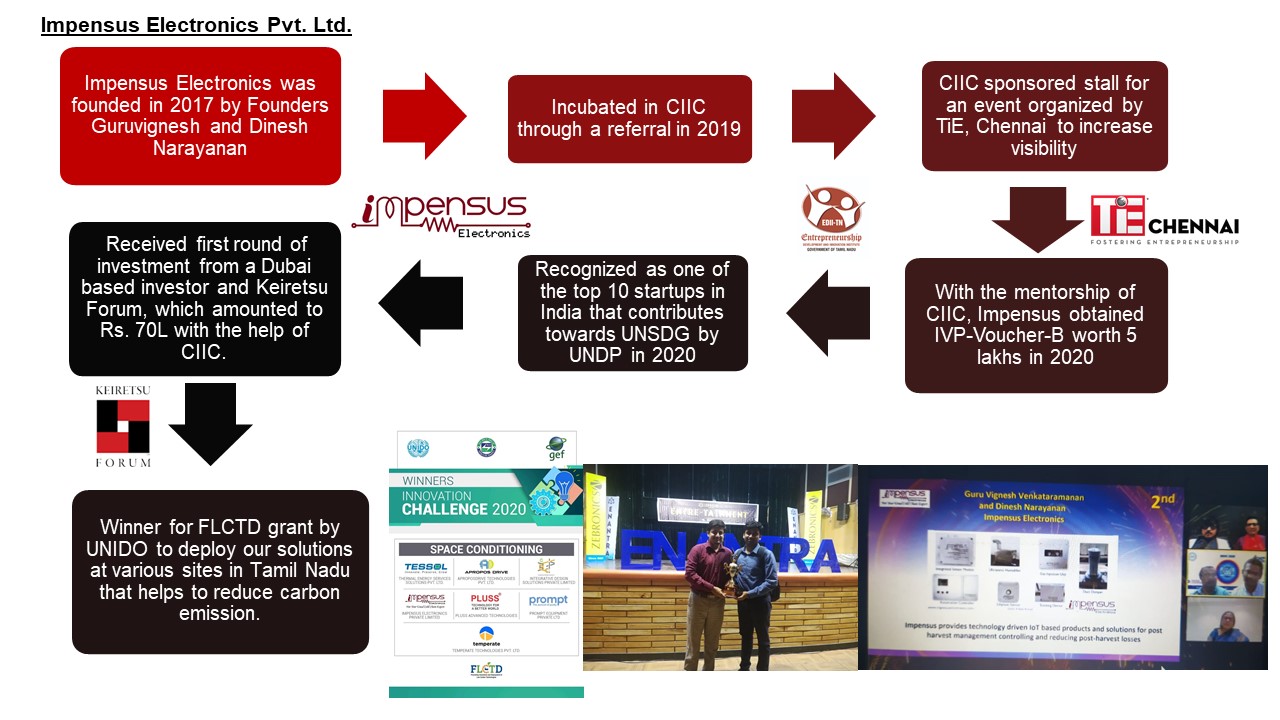

Keiretsu Forum

Keiretsu Forum is a worldwide network of high-net-worth angel investors, family offices, venture capital funds, and corporate and institutional investors. Founded in California in 2000, it is a global source of capital, resources, and deal flow with 55 chapters on four continents and more than 3000 accredited investors as members.